Few people pay attention to a critical measure of the health of our financial system - the federal funds rate.

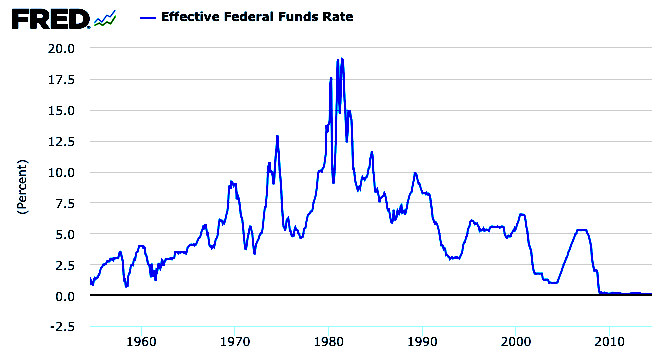

This is the rate that banks pay each other to borrow/lend their excess reserves at the Fed and is an early warning sign of trouble. It identified problems in every economic cycle and gave investors time to reduce the risk in their portfolios. http://research.stlouisfed.org/fred2/series/FEDFUNDS

You can see the spike in this rate as banks fought for funds before each crisis: 1980, 1987, 2000 and 2008. This rate was the best indicator of the 1987 stock market crash. There is a chapter in my book Timing the Market (Wiley & Sons) devoted to the fed funds rate because it helped me prepare for Black Monday in 1987.

The good news is that the fed funds rate has stayed low all year and dropped to an extremely low level at the beginning of September. The financial system is liquid and secure.

The stock market can take comfort in that news.

This is the rate that banks pay each other to borrow/lend their excess reserves at the Fed and is an early warning sign of trouble. It identified problems in every economic cycle and gave investors time to reduce the risk in their portfolios. http://research.stlouisfed.org/fred2/series/FEDFUNDS

The good news is that the fed funds rate has stayed low all year and dropped to an extremely low level at the beginning of September. The financial system is liquid and secure.

The stock market can take comfort in that news.

No comments:

Post a Comment