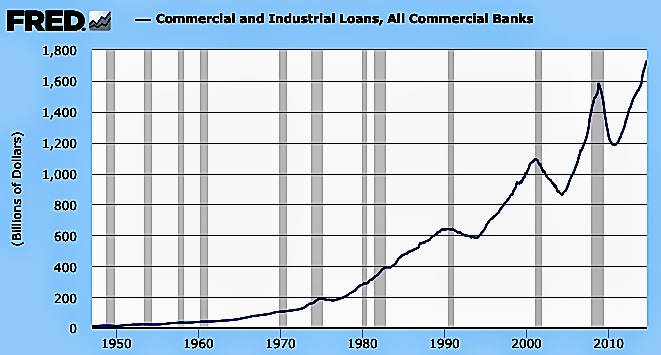

Consumers and businesses are still expanding according to the Federal Reserve Bank of St. Louis. Improved employment is driven this economic growth.

This market hiccup has no basis in fundamental economics. This swoon will pass; in the meantime, this is a good time to add equities to your portfolio.

This market hiccup has no basis in fundamental economics. This swoon will pass; in the meantime, this is a good time to add equities to your portfolio.

1 comment:

Even when interest rates rise, the stock market should do well. Businesses need a moderate amount of inflation in order to raise their prices. Studies show that the market does best when there is moderate inflation.

Low inflation is the result of slow economic growth - such as now. High inflation chokes off growth because funds are too expensive.

Moderate inflation of 2% - 4% has always been best for equities.

Post a Comment