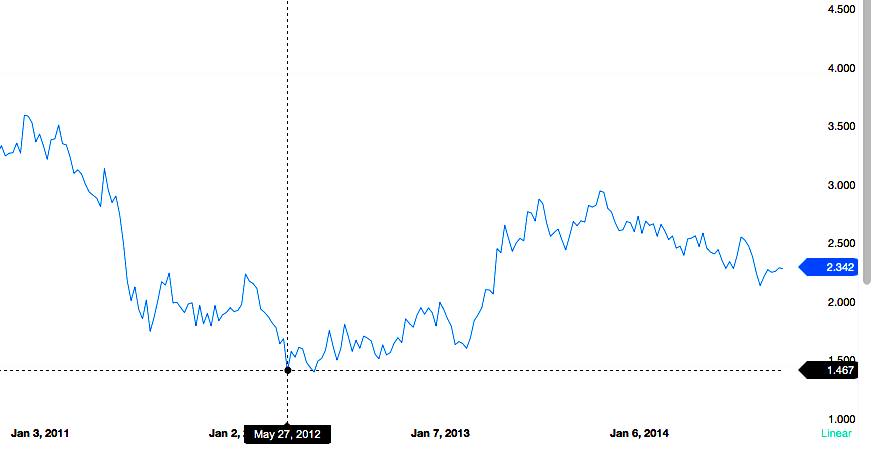

The consensus is often wrong. That may be the case now among those who think we are still in a bond market rally. Investors have lost sight of the fact that the yield on the ten-year note hit bottom in May 2013. (This graph is courtesy of Yahoo.com/tnx.)

Cash is flowing out of fixed-income and into equities. While there will be volatility in both markets, we may be reversing the 30-year rise in bond prices; that could support a long bull market in equities.

No comments:

Post a Comment